Most U.S. home loans end up in the nearly $9 trillion market for residential mortgage bonds with government backing, a critical corner of housing finance that boomed in the wake of the subprime-mortgage crisis.

The “agency” mortgage-bond market resembles the roughly $25 trillion Treasury securities market in that it provides some of the lowest borrowing costs available, and in that defaults are considered unlikely because the bonds come with U.S. government backing.

Fitch Ratings on Tuesday followed through with a May threat to cut the U.S. debt rating, pointing to “fiscal deterioration” expected over the next three years as well as the government’s large and growing debt burden and the “erosion” of governance, including through “repeated debt limit standoffs and last-minute resolutions.”

A day later it also lowered the top AAA debt ratings of housing giants Freddie Mac

FMCC,

Stocks fell Wednesday, with the S&P 500 SPX booking its sharpest daily percentage decline since April, while the 10-year Treasury yield BX:TMUBMUSD10Y rose to nearly 4.1%, as investors focused on the Treasury’s big $1 trillion borrowing plan for the third quarter.

Here’s what to know about the biggest part of the U.S. housing finance market now that Fitch has become the first major credit-rating firm to lower the U.S.’s AAA credit rating to AA+ since S&P Global cut its rating in 2011.

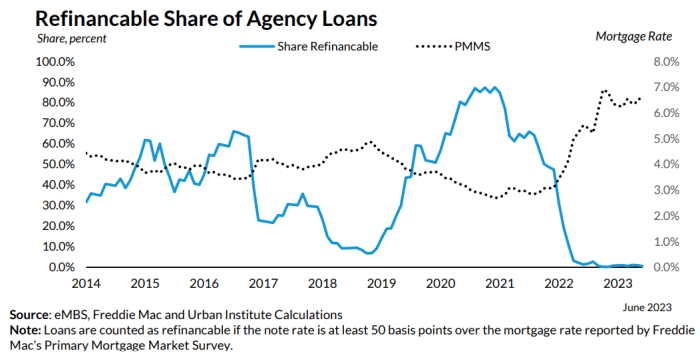

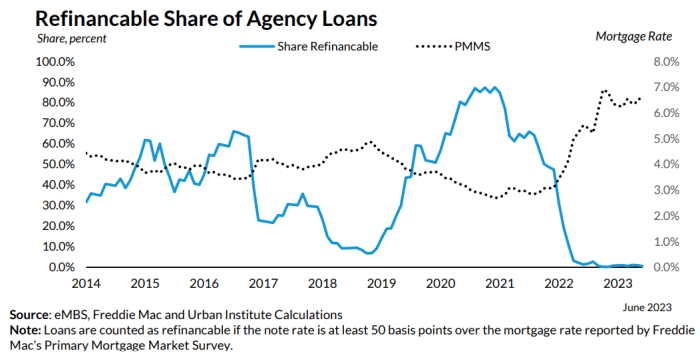

Refi wave is a big buffer

The good news is that most U.S. homeowners already refinanced during the pandemic as the 30-year fixed mortgage rate fell to a 2.68% low in December 2020 from 4.87% in November 2018, according to data from the Urban Institute.

That provides a cushion for homeowners sitting tight with ultralow mortgage rates, sparing them the brunt of the Fed’s rate-hiking campaign.

It also should limit any reverberations from Fitch’s decision to no longer apply its top ratings to U.S. debt. The chart below drives the point home, showing that almost no mortgages are ripe for refinancing with rates hovering around 7%.

The share of U.S. home loans in a position for refinancing has fallen to almost zero.

eMBS, Freddie Mac, Urban InstituteMortgage-backed securities a ‘haven play’

Agency mortgage bonds continue to be viewed in financial markets as a safe-haven play. Like the rally in the Treasury market in 2011 following S&P Global’s surprise downgrade of U.S. credit, Fitch’s rating move could be a shot in the arm for agency mortgages.

“I would not expect this downgrade by itself to have a meaningful impact on the spreads attaching to agency [mortgage-backed securities],” said Yesha Yadav, a professor of law at Vanderbilt University, adding that the sector staged a powerful rally following the S&P Global downgrade roughly a decade ago.

Spreads are the premium investors are paid on bonds above the risk-free Treasury rate, while also serving as a gauge of risk sentiment.

“Of course, there may be broader concerns surrounding the housing market and possible defaults arising out of higher rates,” Yadav said.

She also flagged a “larger and deeper worry” signaled by Fitch in its downgrade: How much can investors continue to trust the default-free reputation of U.S. Treasury securities with Congress continuing to use U.S. credit ratings as a “bargaining chip in negotiations”?

U.S. debt load in focus

Agency mortgage bonds are pools of home loans that are underwritten to stricter credit standards than prevailed in the run-up to the 2007-2008 global financial crisis. U.S. housing giants Freddie Mac and Fannie Mae don’t make home loans, but they do buy ones that fit their tighter lending criteria and issue pools of bonds with the implicit backing of the U.S. government.

Freddie and Fannie didn’t immediately respond to a request for comment. Fitch didn’t respond to a request for comment for this article.

Read: What Fitch’s U.S. credit downgrade means for investors

While financial markets are largely expected to shake off the U.S. losing its top AAA debt rating for a second time in roughly a decade, it could usher in a period of greater “fiscal austerity,” with the lowered ratings likely to become “a political lighting rod,” according to Oxford Economics.

Also, while the Federal Reserve may have only a few more rate hikes in its arsenal before it calls it quits on its inflation fight, the mortgage industry is tethered to fluctuations in longer-dated Treasury yields.

Scott Buchta, head of fixed-income strategy at Brean Capital, told MarketWatch the Fitch downgrade of the U.S. looks less concerning than the potential for volatility in the mortgage market from higher Treasury yields on the back of heavy new supply.

The Treasury earlier this week said it expects to borrow about $1 trillion in the third quarter, an amount that Vivien Lou Chen writes is the largest ever for that time frame and a potential source of pain for investors.

“A bigger concern for the mortgage market is the amount of debt that’s expected to be issued,” Buchta said.