It’s Fed decision day, and this ain’t no disco, this ain’t no foolin’ around.

“It’s the first time in a long time the FOMC has a real decision to make,” says JonesTrading’s chief strategist Michael O’Rourke, who is among the handful urging the Fed to pause. “Remember, this banking crisis is the result of banks that did not prepare properly for an interest-rate increase cycle. Another increase in the near term aggravates the problems at banks.”

Softer stock futures indicate investors are on a bit of a knife edge, following the first-back-to-back gains for the S&P 500

SPX,

Onto our call of the day, which sees some silvery linings out there via one sector that few may be paying attention to right now. In a note to clients, Fundstrat’s head of technical strategy Mark Newton, says healthcare has “suddenly come to life,” a good sign for broader markets.

Before we get into that, he sees a “moment of truth,” nearing for the S&P 500. “It’s thought this lies at 4,043 up to 4,078, or 3/6/23 highs,” he said. The index closed above 4,000 for the first time since March 6 on Tuesday.

“Healthcare is now higher by +1.43% over the past week in equal-weighted terms

RYH,

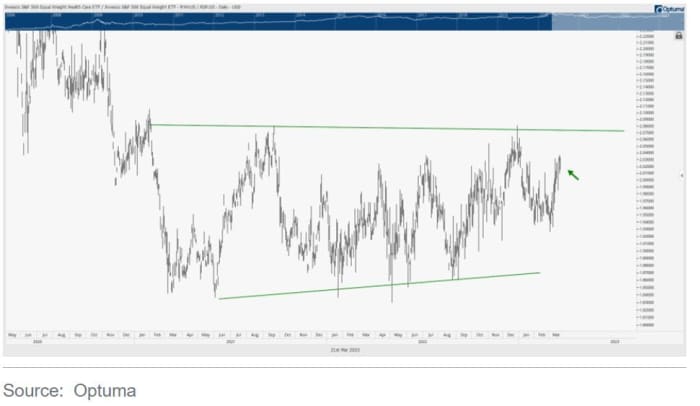

He says his relative chart of healthcare versus the S&P 500 below shows a “steep ascent” has begun. “Since healthcare is the second largest sector in the S&P 500 by market capitalization at nearly 12%, and larger than financials, seeing this sector start to advance is a good sign for market bulls.”

S&P 500 Equal Weight Health Care ETF Invesco/S&P 500 Equal Weight ETF

Optuma/FundstratHowever, much is on the line here as Newton says given the sector’s failed prior breakout attempt into year-end , healthcare needs to exceed those recent gains before anyone can start thinking it’s headed higher than the broader market.

While the market was glued to the fate of regional lenders, medical devices broke out as a subindustry group on Wednesday, and biotech is setting up for something similar, said the strategist, who notes the iShares Medical Devices ETF

IHI,

“This is a bullish development and bodes well for this part of healthcare to start showing better technical strength than what’s been seen since early February,” he said. A test of the highs seen that month are likely, with $56.16 the big resistance level to watch on that ETF, said Newton, who points to his favorite liquid names within it as IDEXX Laboratories

IDXX,

He also notes some bullish technical action recently for Ominicell

OMCL,

Newton says biotech is also close to breaking out, but needs a bit more umpfh given it has lagged behind the tech move seen over the past month. So, for example, any move back over $128 in the iShares Biotechnology ETF

IBB,

Names to consider: Regeneron Pharmaceuticals

REGN,

Read: Wall Street analysts predict approval for another ALS drug

The markets

U.S. stock futures

ES00,

The British pound

GBPUSD,

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

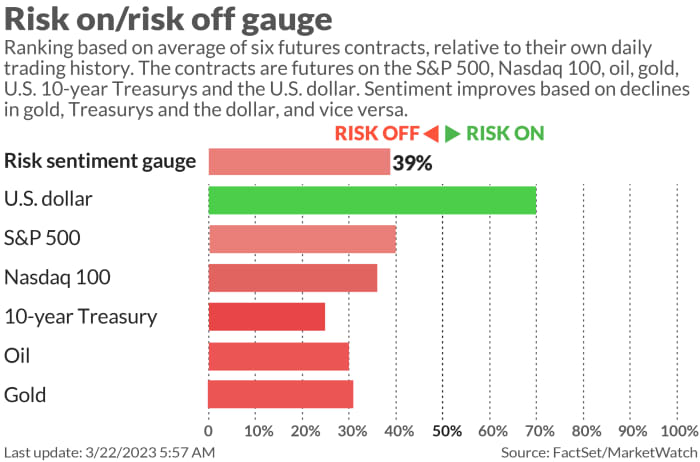

The Fed decision is front and center for markets, the toughest to call since 2008, say some. Some 73% expect a quarter-point move, while the rest say the central bank will do nothing. The economic calendar is otherwise empty.

On the heels of a 30% rally on Tuesday, First Republic

FRC,

Read: 24 bank stocks that contrarian bottom-feeders can feast on now

Shares of GameStop

GME,

Nike

NKE,

China has reportedly granted emergency use for its first homegrown mRNA COVID vaccine.

Best of the web

How bank chaos triggered wild swings in rate expectations ahead of Fed meeting

Bill Gates says he’s blown away by AI.

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security name |

|

GME,

| GameStop |

|

TSLA,

| Tesla |

|

FRC,

| First Republic Bank |

|

BBBY,

| Bed Bath & Beyond |

|

AMC,

| AMC Entertainment Holdings |

|

APE,

| AMC Entertainment Holdings preferred shares |

|

NIO,

| Nio |

|

AAPL,

| Apple |

|

NVDA,

| Nvidia |

|

AMZN,

| Amazon |

Random reads

Teens can now get over their breakups with this government’s help.

When a mountain lion wants in your hot tub, best not refuse him.

Do yourself a favor and swim naked.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.